Asset Tokenization in Fintech

Comprehensive Technical Report Date: February 2026

Executive Summary

Asset tokenization — the process of digitizing ownership of physical and financial assets into blockchain‑native tokens — is emerging as a pivotal innovation in financial technology (Fintech). By combining distributed ledger technology (DLT) with programmable smart contracts, tokenization promises to enhance liquidity, expand access, improve efficiency, and enable 24/7 global markets. The adoption spans both retail and institutional layers, from tokenized equities and bonds to real estate, commodities, and alternative assets. However, tokenization faces significant challenges including regulatory uncertainty, legal enforceability of digital ownership, infrastructure fragmentation, and liquidity bottlenecks.

This report reviews the current state of asset tokenization, technical mechanisms, industry developments, case studies, and implications for the future of financial markets, and concludes with recommendations for stakeholders.

Key findings include:

- Continued institutional adoption with tokenized money market funds and tokenized equities gaining traction. (marketwatch.com)

- Regulatory authorities actively shaping frameworks to manage risk and investor protection. (disruptionbanking.com)

- Tokenization technologies supporting fractional ownership, 24/7 trading, and automated compliance. (britannica.com)

- Persistent barriers in legal recognition and marketplace liquidity. (arxiv.org)

1. Introduction / Background

1.1 What is Asset Tokenization?

Asset tokenization is the process of representing rights to real-world assets as digital tokens on a blockchain. These tokens can be fungible (interchangeable units like tokenized shares or bonds) or non-fungible (unique assets like tokenized art pieces). The underlying blockchain ledger ensures immutability, transparency, and decentralization of ownership records. (britannica.com)

Rather than relying on paper certificates or centralized databases, tokenization leverages distributed ledgers where ownership transfers, compliance checks, and settlement events can execute via smart contracts — programmable protocols that autonomously enforce predefined rights and conditions. (console.settlemint.com)

1.2 Historical Context and Evolution

Asset ownership and market infrastructure have gradually evolved: from paper certificates to electronic records and now to blockchain representations. Traditional markets depend on intermediaries like custodians, clearinghouses, and transfer agents. Tokenization aims to reduce these middle layers, lowering friction costs and enabling near-instant settlement. (mckinsey.com)

While tokenization concepts date back several years, recent regulatory initiatives (e.g., the U.S. Genius Act and Europe’s MiCA) and institutional moves (e.g., tokenized funds by JPMorgan) have accelerated mainstream attention in 2025–2026. (barrons.com)

2. Objective and Key Questions

Primary Objective: To assess how asset tokenization is reshaping modern finance — technically, institutionally, and economically — covering developments across retail and institutional use cases.

Key Questions:

- What are the core technical mechanisms enabling asset tokenization?

- How are tokenized assets being adopted across markets (equities, funds, real estate, commodities)?

- What regulatory and legal frameworks are emerging?

- What challenges and risks accompany tokenization?

- What are the implications for financial infrastructure and market participants?

3. Scope

This report focuses primarily on developments and trends from 2023 to early 2026, spanning both institutional (banks, asset managers, exchanges) and retail (fractional ownership, tokenized products) applications across global markets. It includes:

- Blockchain infrastructure and token standards

- Examples of institutional tokenized products

- Regulatory frameworks and guidance

- Technical, liquidity, and legal challenges

- Case studies (e.g., tokenized equities, money market funds)

4. Technical Overview

4.1 Distributed Ledger and Smart Contract Foundations

At its core, tokenization relies on blockchain or distributed ledgers that record token metadata, ownership rights, and transfer histories. Smart contracts — self-executing code — automate settlement and enforce compliance, governance rules, and dividend distributions without manual intervention. (fintechcircle.com)

Key Features:

- Immutability: Records cannot be altered once written.

- Programmability: Tokens can encode conditions like vesting schedules or regulatory filters.

- Global interoperability: Cross-border access and settlement. (coingecko.com)

4.2 Token Standards and Types

Token standards (e.g., ERC-20 for fungible, ERC-721/ERC-1155 for non-fungible tokens) define how tokens operate on networks like Ethereum or other smart contract platforms. Some systems support hybrid architectures (public/private chain models) for permissioned markets. (brickken.com)

Token Types:

| Type | Characteristics | Example Use Cases |

|---|---|---|

| Fungible Tokens | Interchangeable units | Tokenized bonds, equities |

| Non-Fungible Tokens (NFTs) | Unique tokens | Collectibles, real estate slices |

| Stablecoin-Backed Tokens | Pegged value | Tokenized funds, payments |

5. Data, Evidence & Industry Trends

5.1 Market Adoption and Institutional Products

Recent developments signal real adoption among major financial institutions:

- JPMorgan Chase launched “My OnChain Net Yield Fund”, a tokenized money market fund for institutional and accredited retail investors. (barrons.com)

- Tokenized equities and stocks are expanding markets with 24/7 trading and reduced settlement times. (marketwatch.com)

- Firms like Securitize Inc. have issued over $4 billion in tokenized assets including treasury funds, equity tokens, and institutional funds. (en.wikipedia.org)

5.2 Global Regulatory Movement

Regulators recognize the potential and risks of tokenization:

- IOSCO published a final report on financial asset tokenization to guide member authorities in protecting investors and market integrity. (disruptionbanking.com)

- Countries like China tightened oversight of tokenized asset-backed securities to mitigate risks. (reuters.com)

- Leading markets (e.g., Singapore and Hong Kong) continue sandbox and pilot initiatives to integrate tokenization with traditional markets. (timesofindia.indiatimes.com)

5.3 Market Size & Projections

- Tokenized real-world assets (RWAs) reportedly exceeded $50 billion in 2024, with projections suggesting exponential growth. (console.settlemint.com)

- A Boston Consulting Group study estimates tokenized fund assets under management could exceed $600 billion by 2030. (bcg.com)

- Regional forecasts indicate tokenized markets may reach $10–19 trillion by 2030–2033 in some segments. (ainvest.com)

6. Case Studies / Examples

6.1 Tokenized Money Market Fund — JPMorgan

JPMorgan’s launch of the MONY fund exemplifies how traditional asset managers use blockchain to offer familiar products with enhanced features like faster settlement and programmable compliance. (barrons.com)

6.2 Tokenized Equities & Retail Markets

Tokenized equities allow 24/7 trading, near-instant settlement, and fractional ownership, potentially competing with legacy exchange mechanisms. Platforms such as Kraken have reportedly surpassed $10 billion in tokenized stock trading. (marketwatch.com)

6.3 Singapore’s Tokenization Pilots

Under initiatives like Project Guardian, Singapore’s financial ecosystem has enabled pilot tokenized bonds, e-VCC funds, and compliance workflows involving global custodians and asset managers. (investax.io)

7. Discussion / Implications

7.1 Benefits of Tokenization

Liquidity & Accessibility: Tokenization allows fractional ownership and broader investor access, especially in illiquid assets like real estate or private markets. (britannica.com)

Efficiency & Cost Reduction: Smart contracts automate settlement and compliance, reducing back-office costs and intermediaries. (assettokenization.com)

Transparency & Security: Immutable blockchains enhance audit trails and reduce fraud risk. (coingecko.com)

7.2 Challenges and Limitations

Despite potential, significant hurdles remain:

- Regulatory Uncertainty: Legal recognition of tokenized ownership is still evolving. (disruptionbanking.com)

- Liquidity Gaps: Some tokenized assets show low secondary market trading volumes. (arxiv.org)

- Legal & Custody Risks: Enforcing digital ownership and custody in traditional legal systems remains complex. (britannica.com)

Infrastructure Fragmentation: Multiple networks and standards create interoperability challenges.

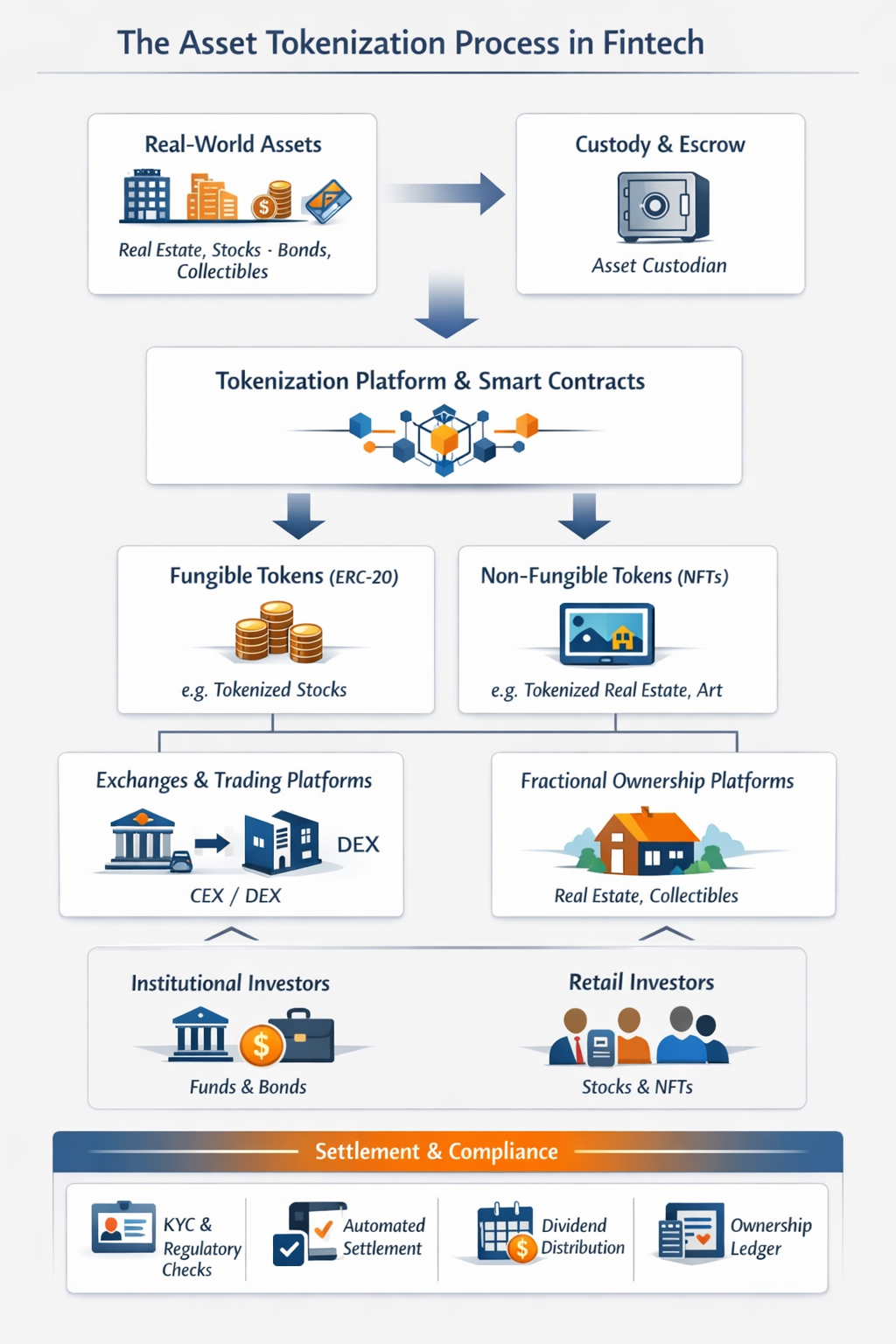

8. Technical Diagrams

8.1 Asset Tokenization Architecture

[Real-World Asset]

│

▼

[Asset Custodian]

│

▼

[Tokenization Platform / Smart Contract]

│

┌────┴─────┐

▼ ▼

[Fungible Token] [NFT / Non-Fungible Token]

│ │

▼ ▼

[Exchanges / Trading Platforms]

│

▼

[Investors (Retail & Institutional)]

8.2 Token Lifecycle

[Asset Identification] → [Legal Structuring] → [Token Minting] → [Compliance Check]

│ │ │ │

▼ ▼ ▼ ▼

[Custody & Escrow] → [Smart Contract Deployment] → [Trading / Fractional Ownership] → [Redemption / Settlement]

8.3 Retail vs Institutional Token Use Cases

┌───────────────┐

│ Asset Tokenization │

└───────────────┘

│

┌──────────────┴──────────────┐

▼ ▼

[Institutional Use Cases] [Retail Use Cases]

│ │

┌─────┴─────┐ ┌─────┴─────┐

▼ ▼ ▼ ▼

Tokenized Tokenized Fractional Tokenized

Funds Bonds Real Estate Collectibles

Stocks Money Market Stocks Art / NFTs

8.4 Settlement & Compliance Workflow

[Investor A] [Investor B]

│ │

▼ ▼

[Identity Verification & KYC/AML Checks]

│

▼

[Smart Contract / Token Platform]

│

┌───────────┴───────────┐

▼ ▼

[Ownership Ledger Update] [Compliance Enforcement]

│ │

▼ ▼

[Automated Settlement] [Regulatory Reporting]

│ │

└───────────┬───────────┘

▼

[Dividend / Coupon Distribution]

│

▼

[Investor Wallets / Accounts]

8.5 Combined Asset Tokenization Overview

┌─────────────────────┐

│ Real-World Asset │

│(Real Estate, Stocks,│

│ Bonds, Collectibles)│

└─────────┬───────────┘

│

▼

┌─────────────────────┐

│ Custody / Escrow │

└─────────┬───────────┘

│

▼

┌─────────────────────┐

│ Tokenization Platform│

│ & Smart Contracts │

└─────────┬───────────┘

│

┌─────────────────────┴─────────────────────┐

▼ ▼

┌───────────────┐ ┌───────────────┐

│ Fungible Tokens│ │ Non-Fungible │

│ (ERC-20 etc.) │ │ Tokens (ERC-721│

└───────┬───────┘ │ / 1155 etc.) │

│ └───────┬───────┘

▼ ▼

┌─────────────────────┐ ┌─────────────────────┐

│ Trading / Exchange │ │ Retail & Fractional │

│ Platforms / DEX/CEX │ │ Ownership Platforms │

└─────────┬───────────┘ └─────────┬───────────┘

│ │

▼ ▼

┌───────────────┐ ┌───────────────┐

│ Investor A / B │ │ Investor Wallets│

│ Institutional │ │ (Retail & Institutional) │

└───────────────┘ └───────────────┘

│ │

▼ ▼

┌─────────────────────────────┐ ┌─────────────────────────────┐

│ Settlement & Compliance │ │ Automated Dividend / Coupon │

│ - KYC/AML Checks │ │ Distribution via Smart │

│ - Ownership Ledger Update │ │ Contracts │

│ - Regulatory Reporting │ └─────────────────────────────┘

│ - Automated Settlement │

└─────────────────────────────┘

9. Recommendations / Conclusions

9.1 For Regulators

- Develop harmonized frameworks clarifying the legal status of tokenized assets.

- Establish investor protection guidelines and custody standards.

9.2 For Financial Institutions

- Invest in programmable infrastructure that supports compliance and settlement automation.

- Pilot tokenized product offerings with clear legal models.

9.3 For Technology Providers

- Build interoperable token standards to unify markets.

- Focus on secure custody solutions and transparent governance tools.

Conclusion: Asset tokenization is poised to significantly reshape financial markets by enabling fractional ownership, accelerating settlement speeds, and broadening participation. However, successful integration into mainstream finance requires coordinated efforts across technology, regulation, and market infrastructure.

10. References

- Britannica – What Is Asset Tokenization? [What Is Asset Tokenization? Meaning, Examples, Pros, & Cons